Search WCSU

WCSU Essentials

Automatic translation disclaimer

Translation of this page is provided by the third-party Google Translate service. In case of dispute, the original language content should prevail.

La traducción de esta página la proporciona el servicio Google Translate de terceros. En caso de disputa, prevalecerá el contenido del idioma original.

La traduction de cette page est fournie par le service tiers Google Translate. En cas de litige, le contenu de la langue originale prévaudra.

Financial Accounting or Accounting Analytics

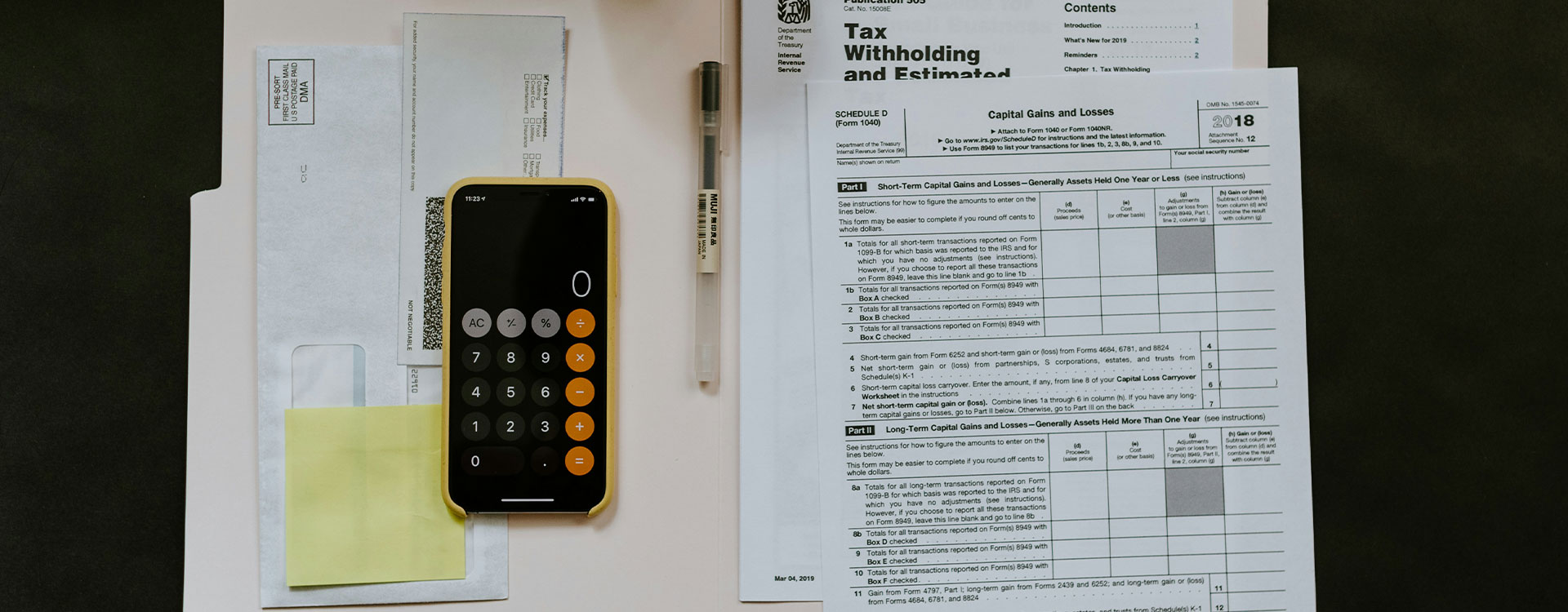

Have Impact: Analyze or audit financial data, ensure compliance with tax and other regulations.

Accountants working for businesses, governments, or non-profits analyze and communicate financial information to stakeholders within and without their organizations. Accountants who become CPAs audit and lend credibility to clients’ financial statements, but also may be tax experts or consultants. Increasingly, these roles mean having skills to manipulate and analyze Big Data.

At WCSU’s Ancell School of Business, our accounting students explore the essential body of accounting knowledge, while developing skills needed for entry into the worlds of financial or managerial accounting.

Our graduates gain problem solving and communication skills, and an understanding of the “big picture” in highly competitive business environments.

We provide students with an education that focuses on the common body of knowledge of accounting and the development and application of skills needed for entry into the profession.

Skilled accounting professionals: the foundation of all successful businesses.

Degree Programs

BBA in Accounting (Financial option):

This track is intended for students whose career interest is the preparation or audit of financial statements intended for external users such as shareholders, analysts, or regulators. Students may go on to take the CPA exam and become Certified Public Accountants (see paragraph on professional licensing and certificates).

This track is intended for students whose career interest is in being part of and providing analysis to management teams responsible for planning, directing, and controlling organizational activities. Students may go on to take the CMA exam and become Certified Management Accountants (see paragraph on professional licensing and certificates).

Students wishing to undertake a minor should consult with the accounting department chair.

Minor in

Accounting

Internships

Internships provide valuable hands on-experience and are a preview of professional life. Accounting firms use internships as the primary vehicle for recruitment and Ancell Accounting students intern with the Big_4 accounting firms as well as many that are regional or local.

WCSU’s Accounting Department graduates are able to:

-

Utilize critical thinking and data analysis skills to prepare and analyze financial statements.

-

Effectively communicate and convey accounting information orally and in writing.

-

Work in a group setting to solve complex financial and accounting problems.

-

Identify and resolve ethical issues related to the practice of accounting.

-

Demonstrate a broad understanding of accounting standards and an ability to resolve problems in the following areas: GAAP-US/IFRS accounting standards, tax rules and regulations, legal issues, fraud principles and standards, and business valuation standards.

-

Academic AdvisementAcademic Advisement

-

Ancell ClubsAncell Clubs

-

Ancell CommonsAncell Commons

-

Ancell ScholarshipsAncell Scholarships

-

Career Success CenterCareer Success Center

-

Course RegistrationCourse Registration

-

InternshipsInternships

-

The Writing CenterThe Writing Center

-

WCSU Clubs and OrganizationsWCSU Clubs and Organizations